About the Dataset

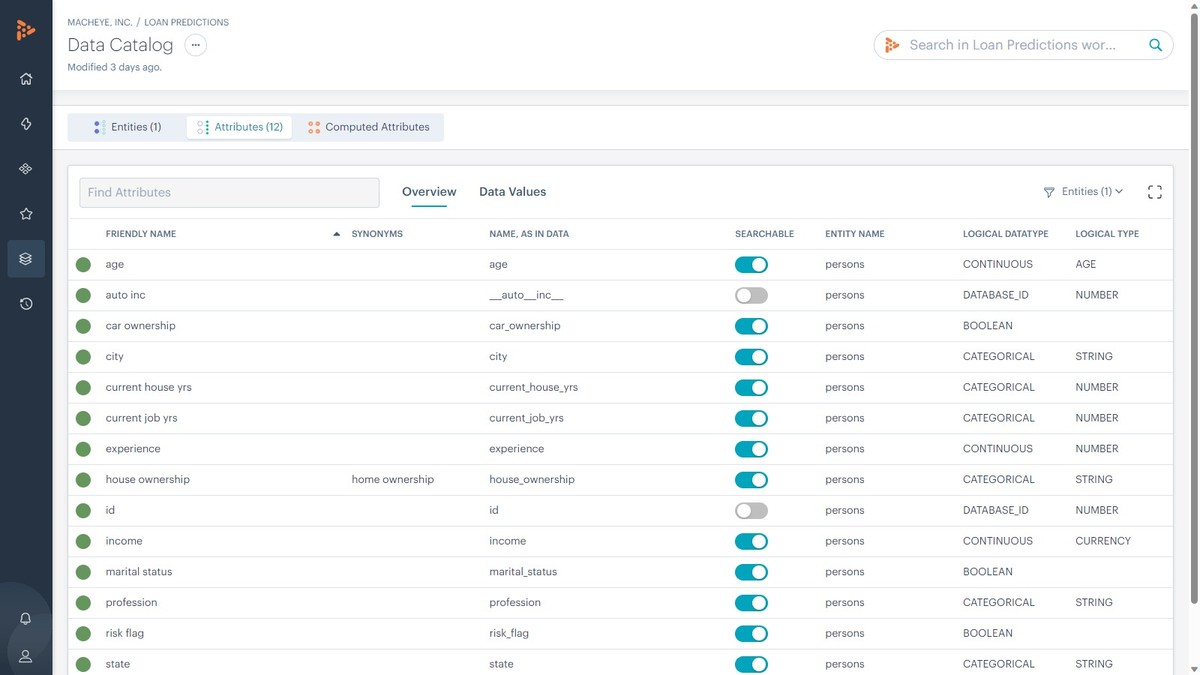

This dataset contains information relevant for building loan prediction models in the financial industry by incorporating customer behavior data. It aims to improve the accuracy of lending decisions by analyzing various aspects of customer behavior, such as credit history, financial management, spending patterns, and employment history. The dataset includes individual records identified by an ID, along with attributes like income, age, experience, marital status, house ownership, car ownership, profession, city, and state.

The key customer behavior indicators in this dataset are:

Credit History: This factor includes credit scores, payment history, and the presence of delinquencies or bankruptcies, providing insights into a borrower's creditworthiness and likelihood of timely loan repayment.

Financial Management: Attributes like income stability, savings habits, debt-to-income ratio, and responsible debt management are essential in evaluating the borrower's financial stability and ability to handle loan obligations.

Spending Patterns: Understanding a borrower's spending habits allows lenders to assess their financial discipline, with high credit utilization or a history of excessive spending potentially indicating a higher risk of default.

Employment History: Stability in employment is crucial for loan repayment. Attributes like job stability, income growth, and industry trends help predict a borrower's ability to generate a steady income and meet loan obligations.

Each record in the dataset represents an individual with specific attributes related to income, age, marital status, house and car ownership, profession, city, and state. These attributes provide valuable insights into the customer's behavior, which can be utilized to build robust loan prediction models, improve credit risk assessment, and make informed lending decisions in the financial services industry.

This dataset is obtained from www.kaggle.com, and this article is published on 03 AUG 2023. Note that the available dataset may only be a small portion of complete set at any given point.

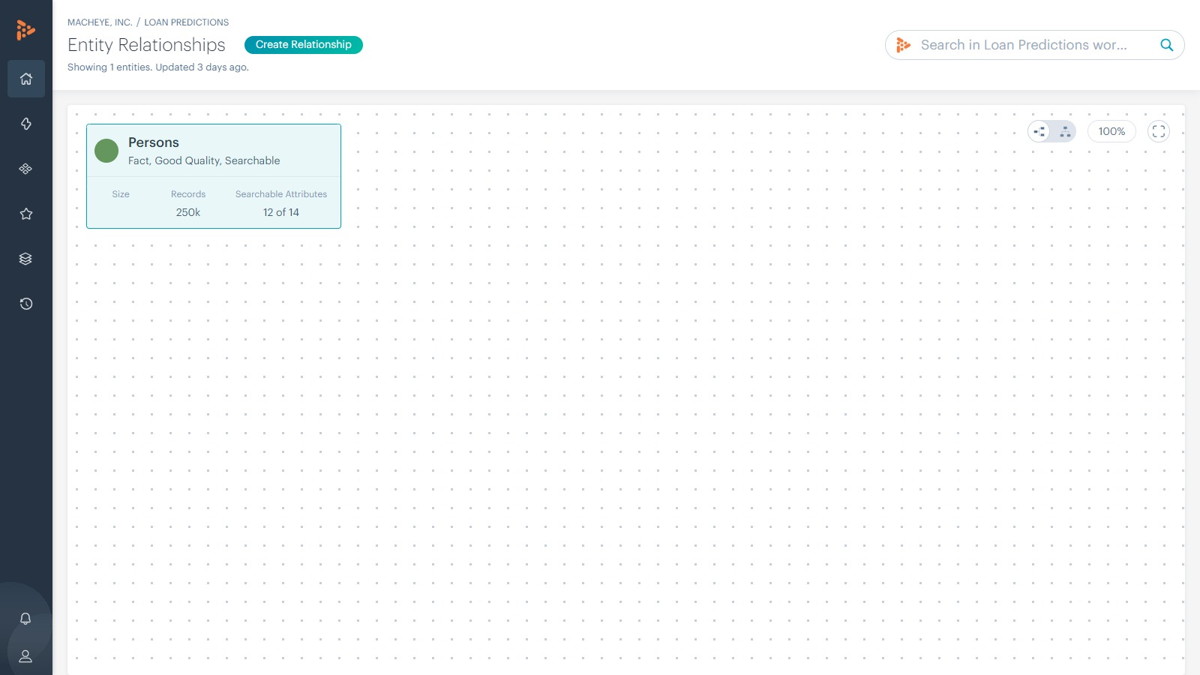

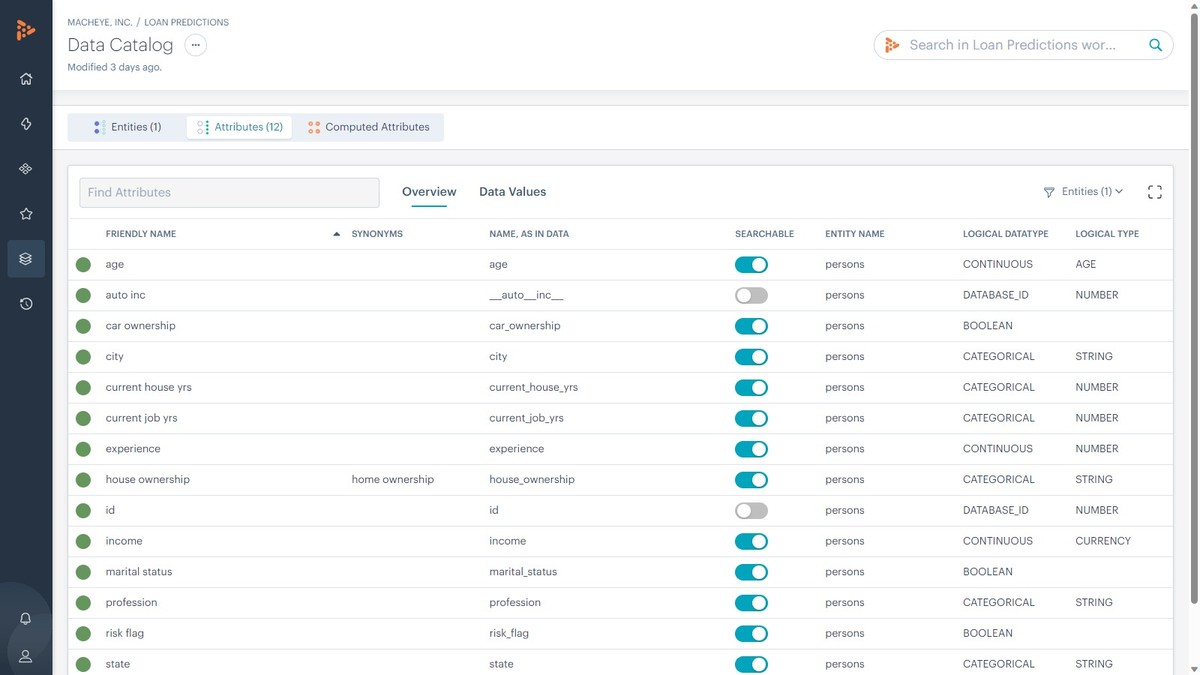

Automated Data Catalog with MachEye

With its low-prep/no-prep data catalog process, MachEye categorizes data into entities and attributes, identifies entity relationships, and enriches the metadata by assigning friendly names. MachEye also measures the quality of data across multiple parameters such as clarity, completeness, consistency, integrity, interpretability, timeliness and uniqueness and scores it on a data quality index. The lower the score, the higher the data quality.

Dataset Insights from MachEye

Here are some interesting answers to questions and insights presented by MachEye on this dataset. These answers and insights are presented in the form of interactive charts, pivot tables, text narratives, and audio-visual data stories.

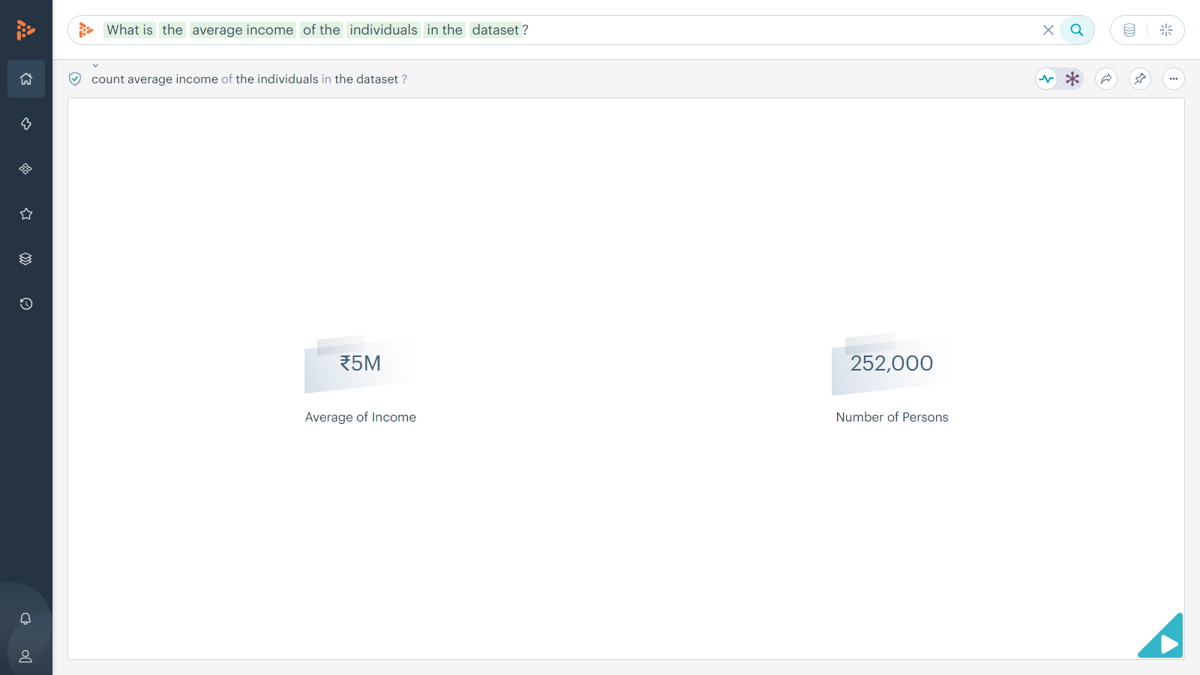

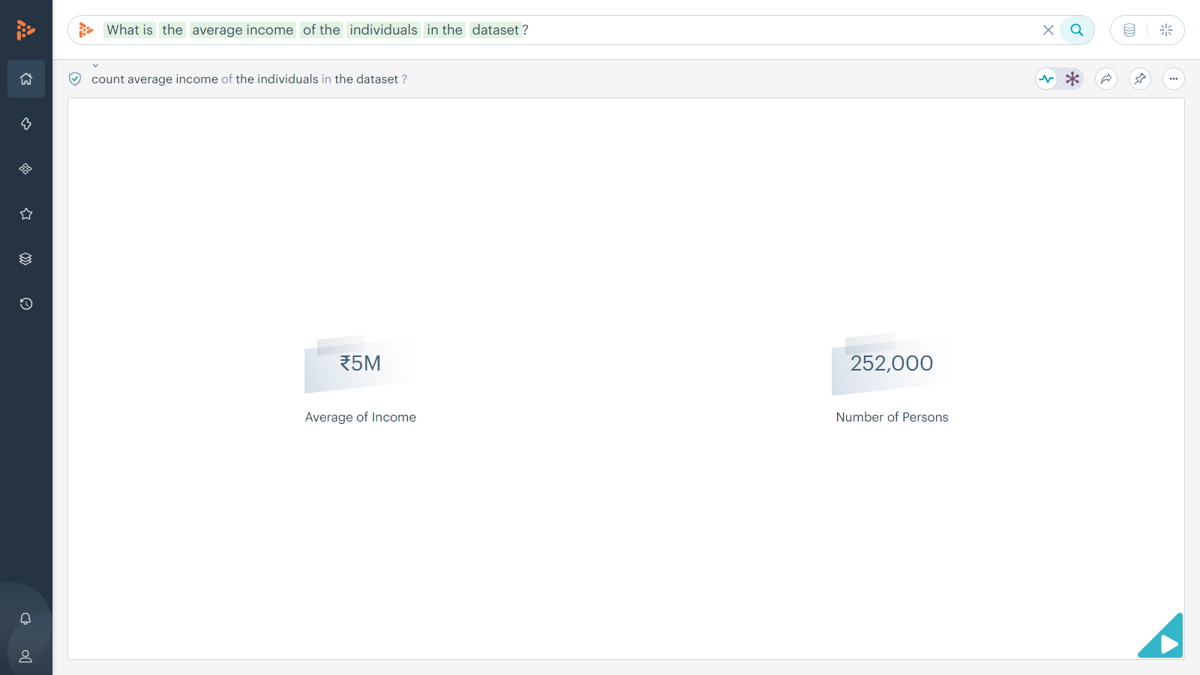

What is the average income of the individuals in the dataset?

The average income among 252,000 individuals is INR 5M.

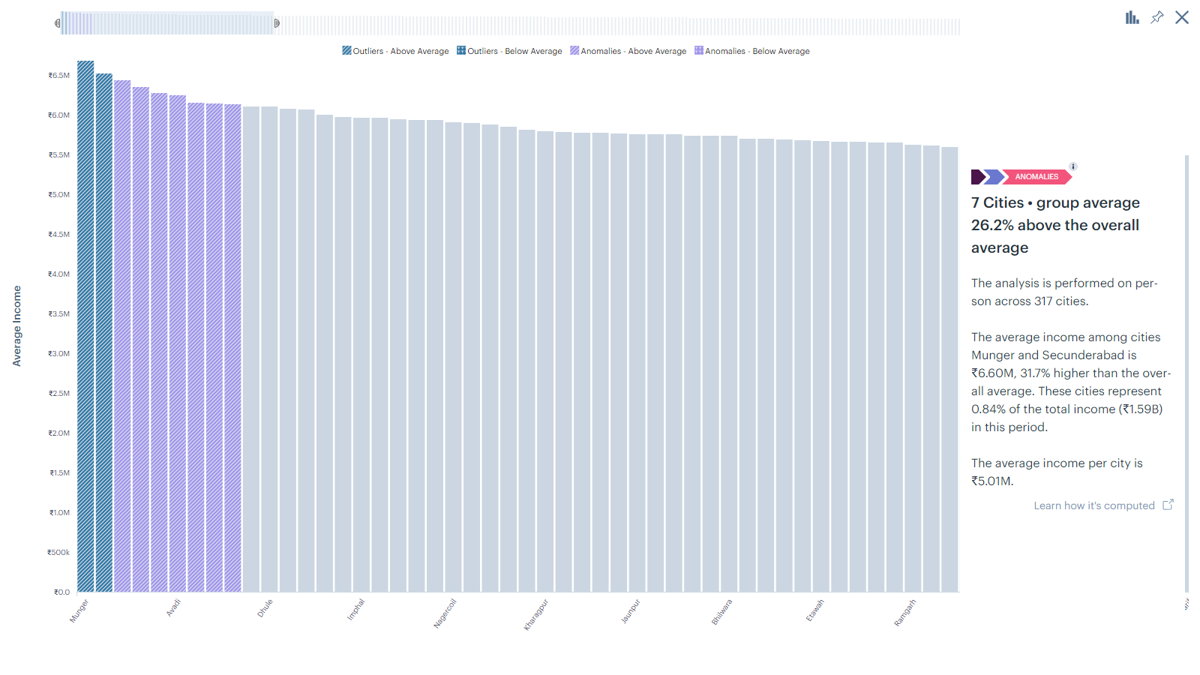

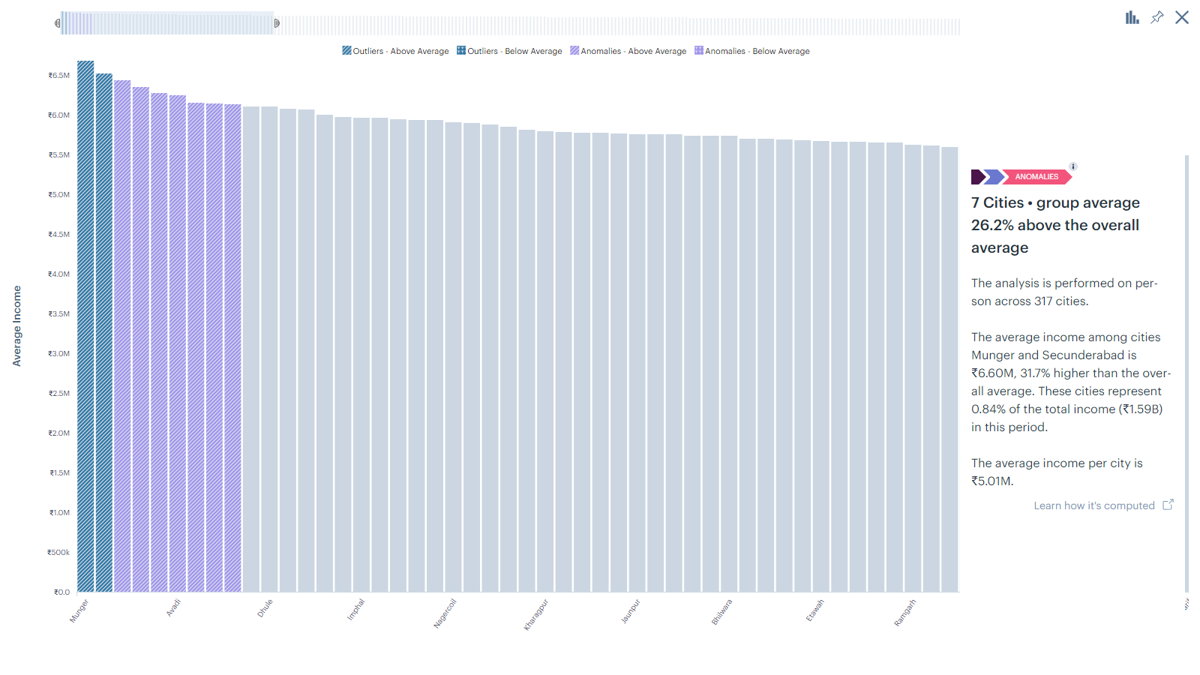

What is the correlation between income and location of the individuals?

The analysis encompasses individuals from 317 cities. Notably, the average income in Munger and Secunderabad is ₹6.60 million, which is 31.7% higher than the overall average. Despite comprising just 0.84% of the total income of ₹1.59 billion during this period, these cities make a significant contribution.

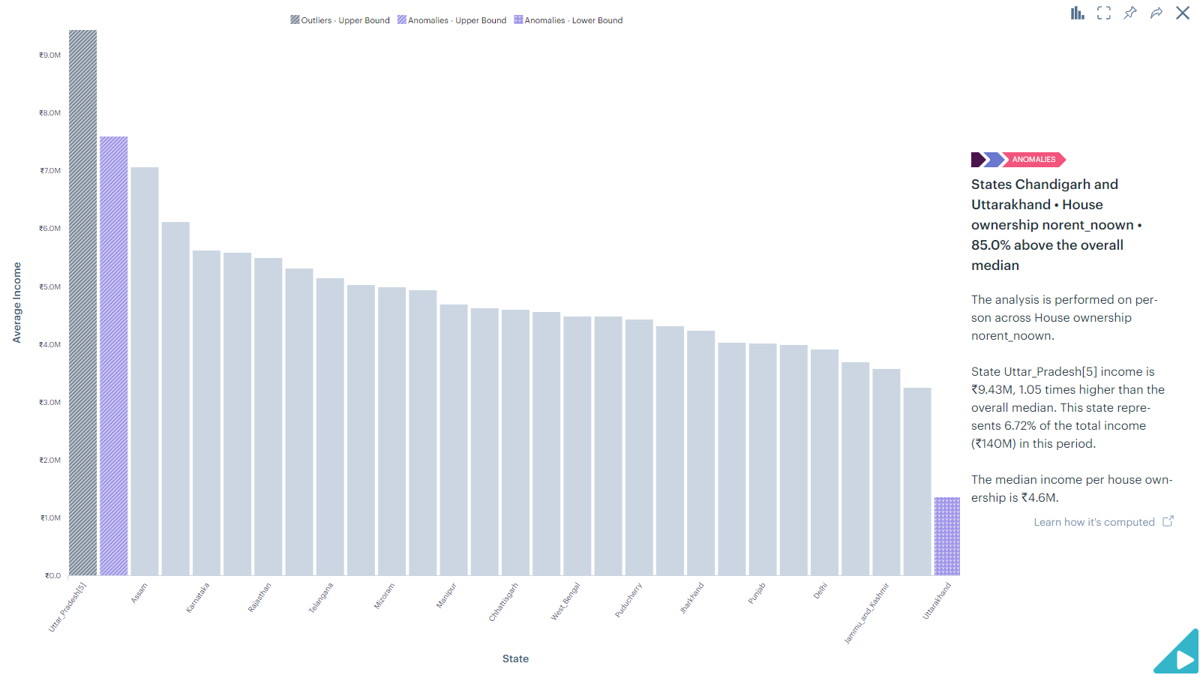

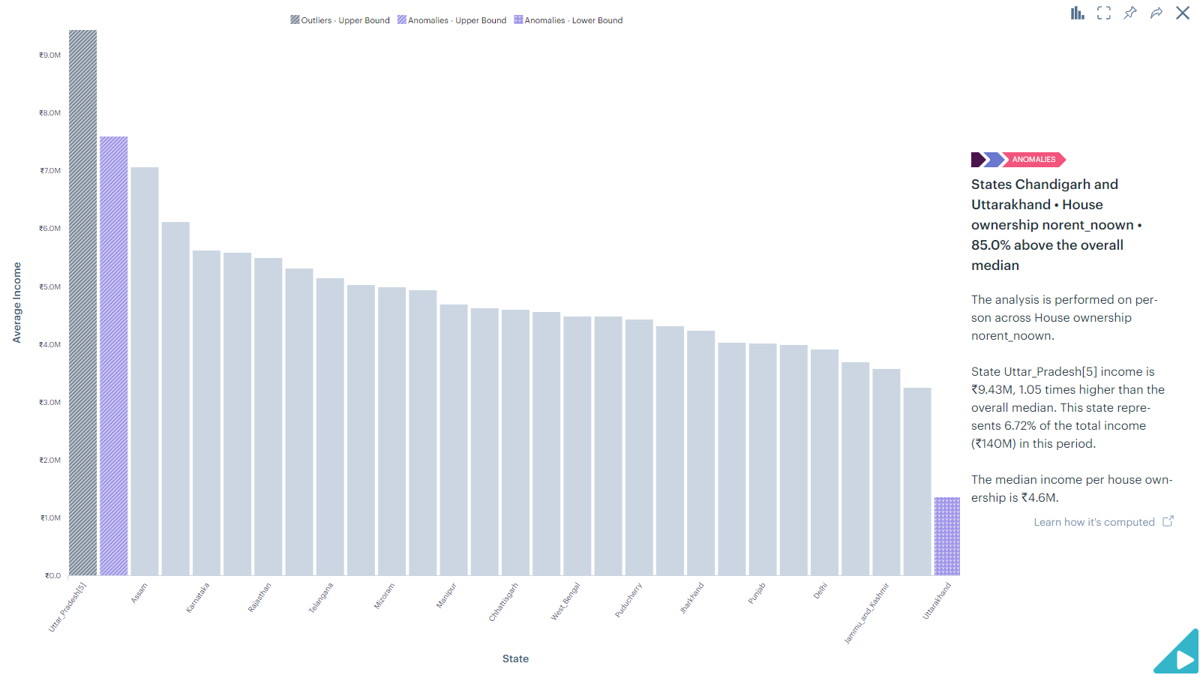

What is the relationship between home ownership and income among the individuals?

State of Uttar Pradesh has a very high income at ₹9.43M, 105% higher than the overall median. This state represents 6.72% of the total income of ₹140M in this period.

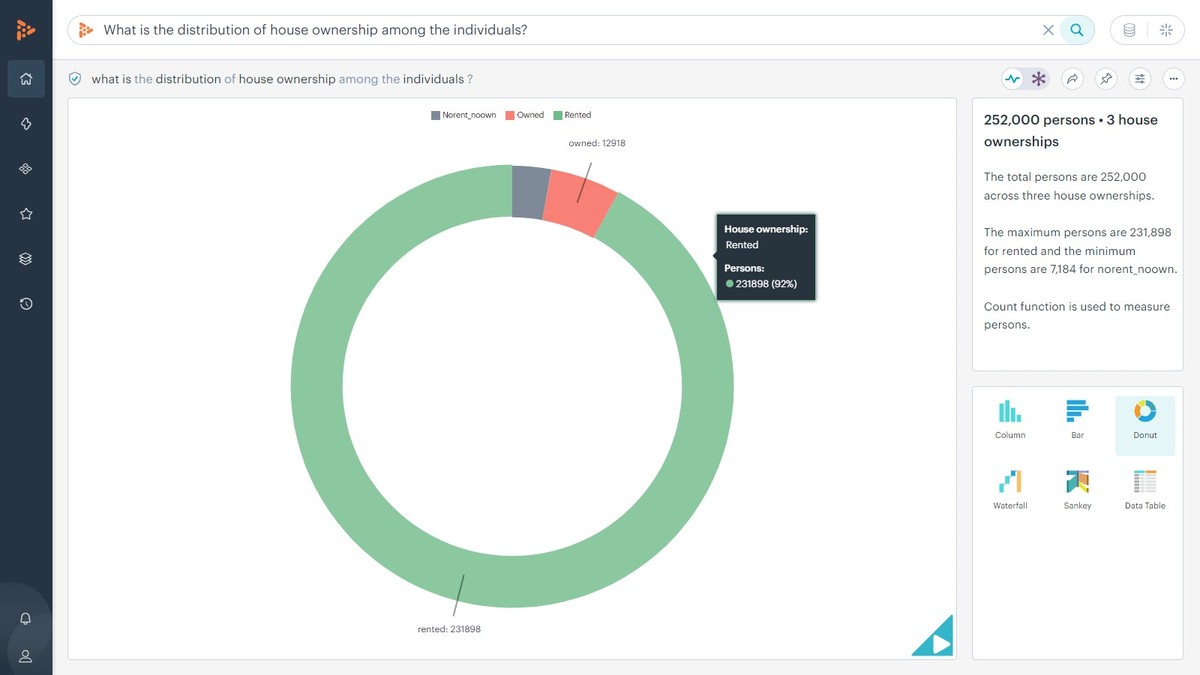

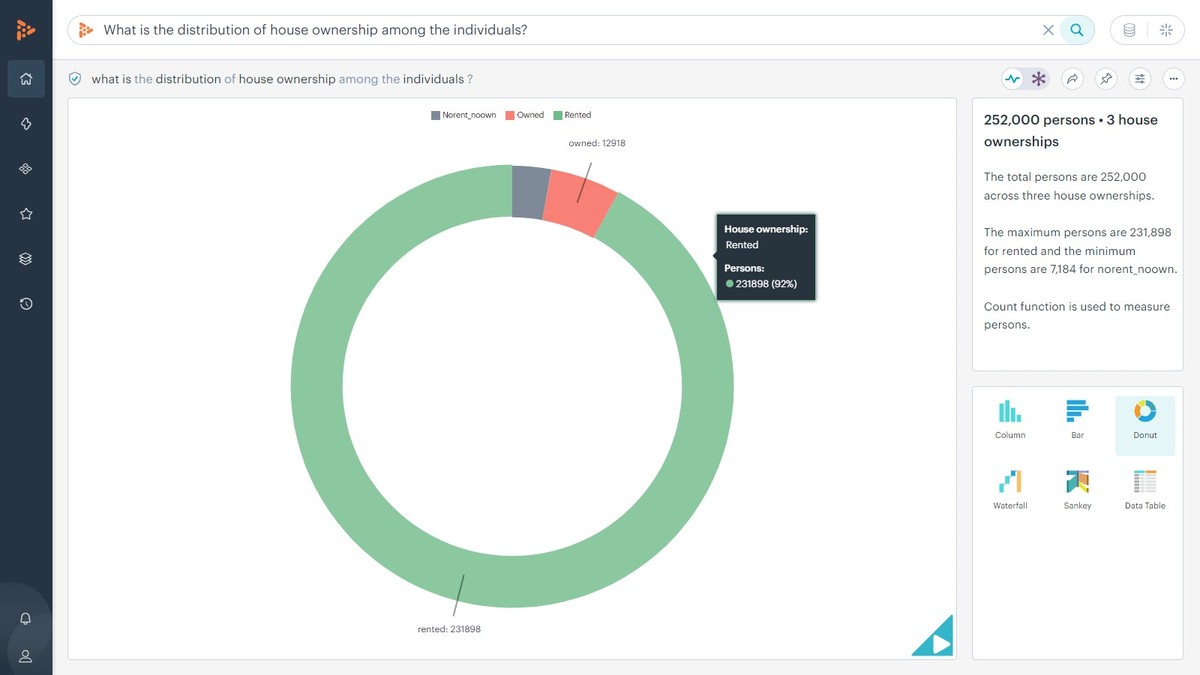

What is the distribution of house ownership among the individuals?

Majority of the individuals at about 238,000 are rented.

What are the top 5 professions with the highest average income?

The top five professions by income are Petroleum Engineer, Psychologist, Designer, Scientist and Surgeon. The average income per person of the top five professions are ₹5.33M.

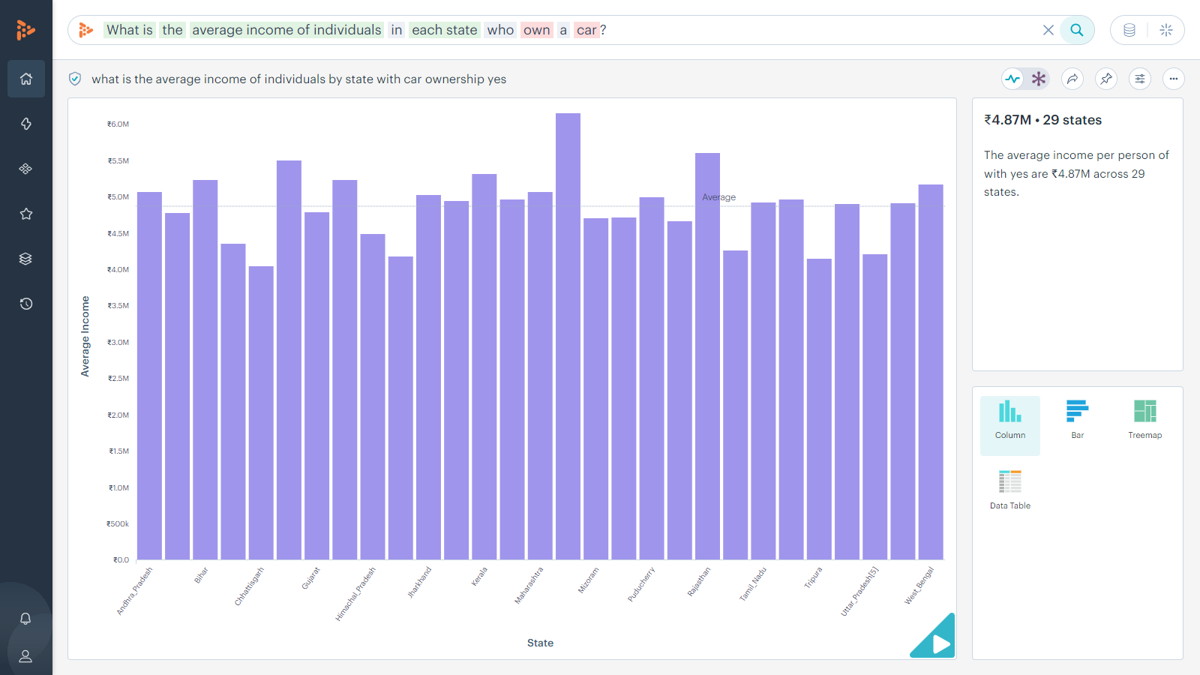

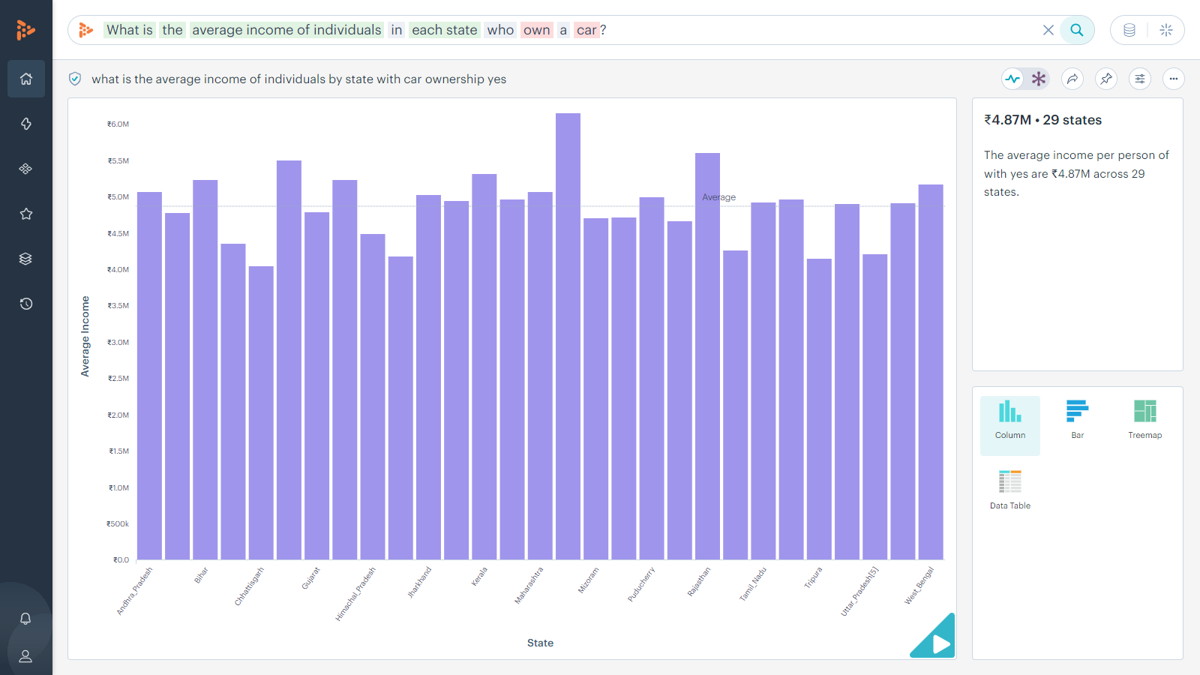

What is the average income of individuals in each state who own a car?

The average income per person with car ownership is ₹4.87M across 29 states. State Manipur income is ₹6.15M, 26.3% higher than the overall average. This state represents 4.36% of the total income (₹141M) in this period.

As you could see, through a user-friendly interface that includes Google-like search and YouTube-like audio-visual experiences, decision-makers at any level can receive actionable insights and recommendations. MachEye adds a new level of interactivity to data analysis with its actionable "play" button feature.

Analyze with MachEye: Try with Your Data Today!

MachEye's analytics copilot delivers intelligent search, actionable insights, and interactive stories on business data. It empowers users with conversational answers, summarized narratives, and immersive audio-visual presentations. Offering comprehensive solutions for 'what, why, and how' scenarios, it features a user-friendly interface resembling Google's search and YouTube's audio-visual experiences. Decision-makers at all levels gain actionable insights and recommendations. MachEye elevates data analysis with its interactive 'play' button.

To analyze your own dataset with MachEye, start today!